Social Security Payroll Tax Limit 2025. This amount is known as the “maximum taxable earnings” and changes. This amount is known as the “maximum taxable earnings” and changes each.

For employees, the maximum social security tax in 2025 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000). 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Social Security Withholding 2025 Binny Cheslie, 2025 social security tax limit increase. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Social Security Tax Wage Limit 2025 Calendar Ashia Callida, The project 2025 playbook suggests that the 30% tax rate should begin “at or near the social security wage base ,” currently $168,600. The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Social Security Earnings Limit For 2025 Shae Yasmin, This amount is known as the “maximum taxable earnings” and changes each. According to the social security administration (ssa), employers and employees each pay 6.2% of wages up to the taxable maximum of $168,600 in 2025,.

Max Taxable For Social Security 2025 Sarah Cornelle, The annual limit — called the contribution and benefit base — does. July 11, 2025 — 04:00 am edt.

Social Security Taxes 2025 Limit Patsy Maurine, The social security wage base is $168,600 for employers and employees,. The social security administration limits the amount of employee earnings that are subjected to social security tax each year.

Social Security Tax 2025 Limit Berry Babette, For employees, the maximum social security tax in 2025 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000). The maximum taxable earnings limit is $168,600 in 2025, meaning any income above that.

Limit For Maximum Social Security Tax 2025 Financial Samurai, 2025 social security tax limit increase. Millionaires are set to hit that threshold in march and won’t pay into the program for the rest of the year.

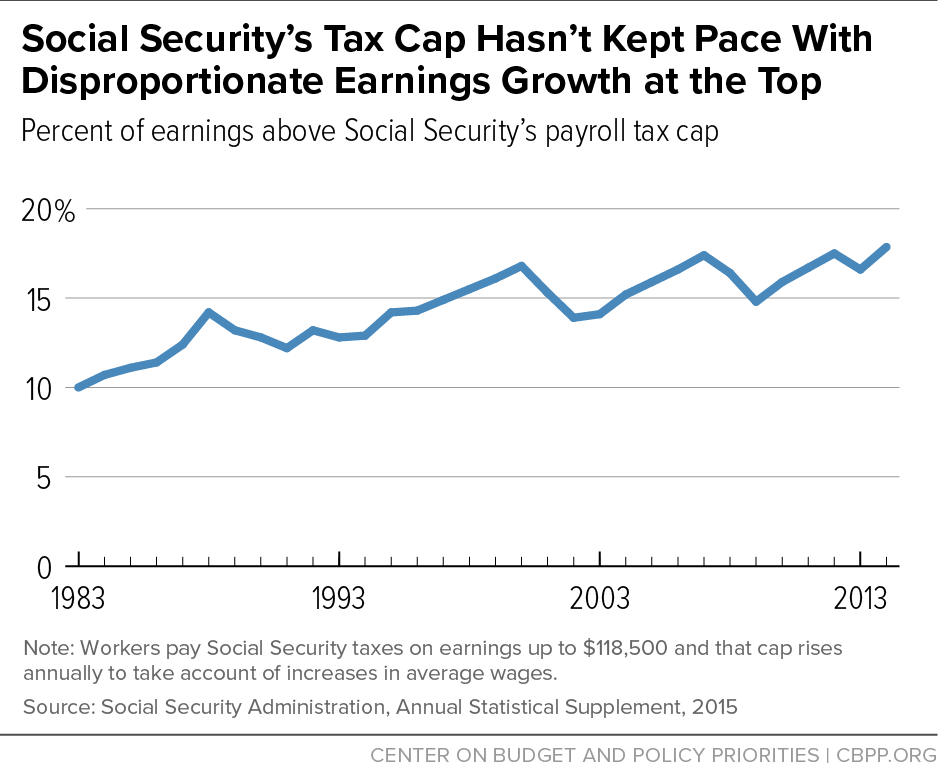

Increasing Payroll Taxes Would Strengthen Social Security Center on, This amount is known as the “maximum taxable earnings” and changes each. The most you will have to pay in social security taxes for 2025 will be $10,453.

Most of Social Security's Comes from Payroll Tax Contributions, Current law caps the income subject to social security payroll tax. The social security wage base is $168,600 for employers and employees,.

Maximum Taxable Amount For Social Security Tax (FICA), The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. In 2025, the social security tax limit rises to $168,600.

You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Equipment Rental WordPress Theme By WP Elemento