How To Pay Quarterly Taxes 2025. Before doing so, talk to a tax professional who can. In this guide, we’ll show you how to calculate and pay your federal estimated quarterly taxes, and walk you through an example that clarifies the process.

If you have little or no income tax withheld from wages and earn significant other income, you may need to make quarterly estimated tax payments to the internal revenue service (irs). The minimum super contribution for sue for the pay period is:

It provides crucial dates and deadlines for submitting returns, paying taxes, and fulfilling other compliance obligations.

You can still use the form to estimate taxes, but if you typically pay your taxes online, you can pay any estimated taxes due using your online account.

How to Calculate and Save Your Quarterly Taxes, If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you. 樂 but they’re a crucial part of running a successful business, and ignoring them can lead.

How to pay estimated quarterly taxes to the IRS YouTube, Ottawa — the first of four payments from the gst/hst credit is set to hit canadians’ bank accounts on july 5. The minimum super contribution for sue for the pay period is:

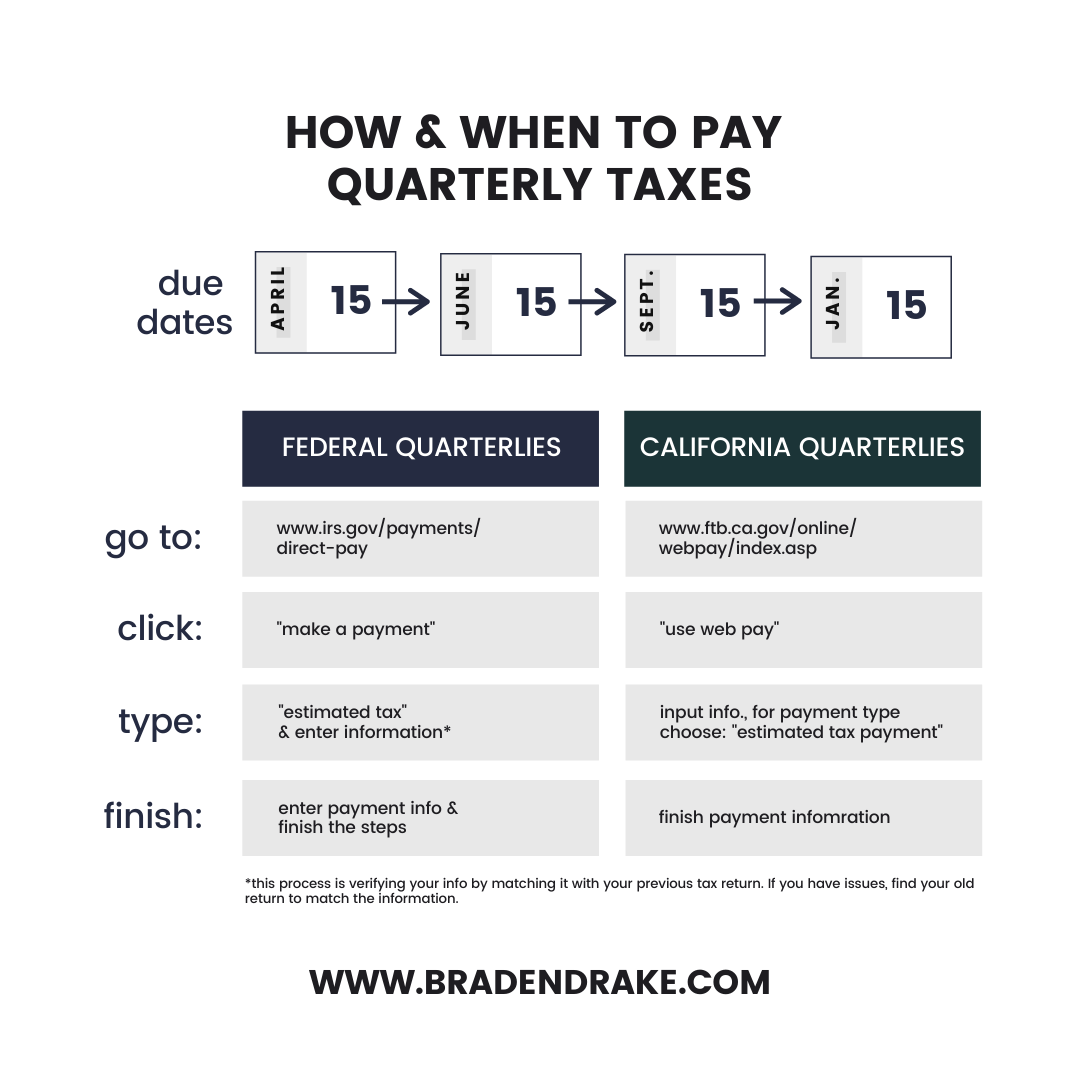

How To Pay Quarterly Estimated Taxes, If you have little or no income tax withheld from wages and earn significant other income, you may need to make quarterly estimated tax payments to the internal revenue service (irs). If you pay quarterly estimated taxes, payments are due on april 15, 2025;

How to Pay Quarterly Estimated Taxes YouTube, Before doing so, talk to a tax professional who can. The minimum super contribution for sue for the pay period is:

How to Pay Your Estimated Taxes Online with the IRS (Quarterly Taxes, Quarterly tax is necessary to pay social security and medicare taxes and income tax because you do not have an employer withholding these taxes for you. Payment options for estimated quarterly taxes there are options for how to pay your estimated taxes.

How to Calculate Quarterly Taxes?, You can pay by check, cash, money order, credit card, or debit card. By estimating based on the previous year’s taxes or by annualizing.

How to Pay Quarterly Estimated Taxes YouTube, If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you. 樂 but they’re a crucial part of running a successful business, and ignoring them can lead.

How To Pay Estimated Quarterly Taxes YouTube, Her first estimated tax payment for the year is due on april 15, 2025. Quarterly payment due dates are printed on each voucher.

![[SOLVED] HOW TO PAY QUARTERLY TAX ONLINE? YouTube](https://i.ytimg.com/vi/vU8ERiAH2lM/maxresdefault.jpg)

Quarterly Taxes Explained How to Pay Estimated Taxes YouTube, Ottawa — the first of four payments from the gst/hst credit is set to hit canadians’ bank accounts on july 5. See what you need to know about estimated tax payments.

[SOLVED] HOW TO PAY QUARTERLY TAX ONLINE? YouTube, The income tax calendar for the f.y. Additional estimated tax payment options, including direct debit, credit card, cash, and wire transfer, are available.